The Facts About Summitpath Llp Revealed

The Facts About Summitpath Llp Revealed

Blog Article

About Summitpath Llp

Table of ContentsWhat Does Summitpath Llp Mean?Get This Report about Summitpath LlpHow Summitpath Llp can Save You Time, Stress, and Money.The Facts About Summitpath Llp UncoveredMore About Summitpath Llp

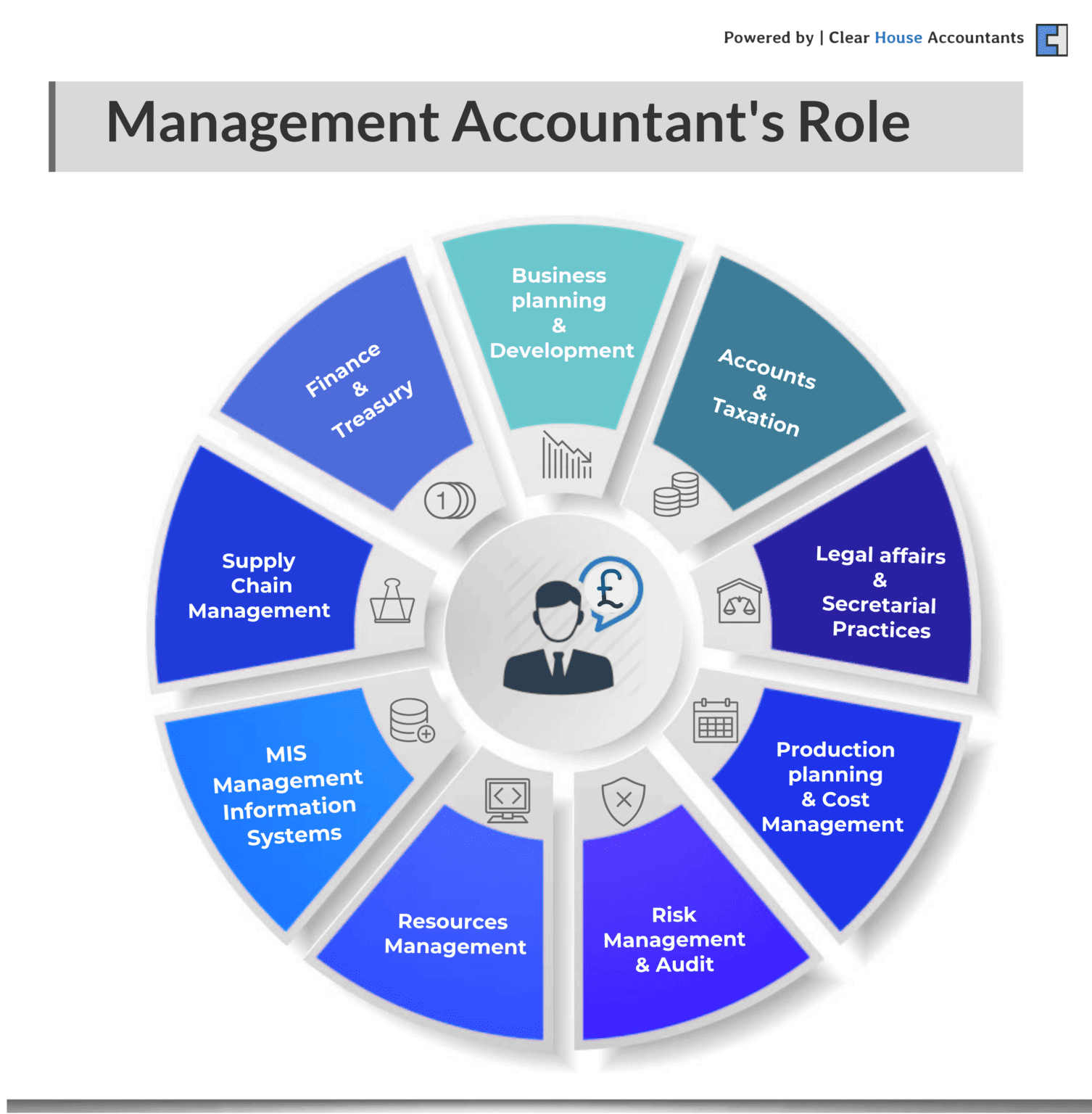

A management accountant is a crucial role within a company, however what is the role and what are they anticipated to do in it? ICAEW digs deeper in this management accounting professional guide. https://peatix.com/user/27118114/view. A management accounting professional is an important duty in any organisation. Operating in the book-keeping or financing department, management accounting professionals are accountable for the prep work of monitoring accounts and several other records whilst likewise managing basic audit procedures and methods within the business.Putting together techniques that will certainly reduce organization prices. Getting finance for jobs. Encouraging on the monetary ramifications of organization decisions. Creating and supervising monetary systems and procedures and determining opportunities to boost these. Managing income and expenditure within business and making sure that expenditure is inline with spending plans. Looking after bookkeeping specialists and assistance with generic accountancy jobs.

Analysing and handling danger within the company. Management accounting professionals play an extremely crucial duty within an organisation. Trick monetary data and records created by management accountants are used by elderly administration to make educated business decisions. The evaluation of organization performance is a vital function in a management accountant's job, this analysis is created by taking a look at present financial details and likewise non - financial information to identify the position of business.

Any kind of organization organisation with a financial department will require a monitoring accounting professional, they are also frequently used by monetary establishments. With experience, a management accountant can anticipate solid career development.

Getting The Summitpath Llp To Work

Can see, assess and encourage on alternative sources of service financing and different methods of increasing financing. Communicates and suggests what influence economic choice making is carrying developments in regulation, principles and administration. Assesses and suggests on the right techniques to handle business and organisational efficiency in regard to service and finance danger while connecting the effect properly.

Utilizes numerous ingenious techniques to apply approach and handle adjustment - Bookkeeper Calgary. The difference in between both monetary audit and managerial accountancy worries the designated customers of details. Managerial accounting professionals require business acumen and their objective is to function as business partners, assisting magnate to make better-informed decisions, while economic accountants aim to generate financial documents to supply to outside parties

Summitpath Llp Fundamentals Explained

An understanding of service is likewise crucial for monitoring accountants, together with the ability to connect successfully in any way degrees to encourage and communicate with senior participants of staff. The obligations of an administration accountant should be carried out with a high degree of organisational and strategic reasoning abilities. The ordinary income for a legal administration accounting professional in the UK is 51,229, a boost from a 40,000 typical made by monitoring accounting professionals without a chartership.

Giving mentorship and management to junior accounting professionals, promoting a society of collaboration, development, and functional excellence. Teaming up with cross-functional teams to create budget plans, projections, Check Out Your URL and long-lasting monetary strategies. Staying informed about changes in accountancy guidelines and best methods, applying updates to interior procedures and documents. Must-have: Bachelor's level in audit, finance, or an associated area (master's liked). CPA or CMA accreditation.

Generous paid pause (PTO) and company-observed vacations. Expert advancement opportunities, consisting of repayment for CPA qualification costs. Versatile work options, including crossbreed and remote schedules. Access to wellness programs and employee help sources. To apply, please send your return to and a cover letter describing your certifications and interest in the elderly accounting professional role. Calgary CPA firm.

The Single Strategy To Use For Summitpath Llp

We're anxious to find an experienced elderly accounting professional prepared to contribute to our company's economic success. Human resources contact information] Craft each area of your work description to reflect your company's unique needs, whether working with a senior accounting professional, corporate accountant, or another professional.

A solid accountant job account goes beyond listing dutiesit clearly communicates the qualifications and expectations that align with your company's needs. Distinguish between crucial qualifications and nice-to-have skills to aid candidates gauge their viability for the placement. Specify any certifications that are necessary, such as a CERTIFIED PUBLIC ACCOUNTANT (State-licensed Accountant) certificate or CMA (Certified Administration Accounting professional) designation.

The Greatest Guide To Summitpath Llp

Adhere to these finest methods to develop a task description that reverberates with the best prospects and highlights the special aspects of the function. Accountancy duties can differ extensively relying on seniority and specialization. Stay clear of uncertainty by detailing details jobs and locations of emphasis. As an example, "prepare monthly financial statements and look after tax obligation filings" is far more clear than "manage economic documents."Reference key areas, such as economic reporting, bookkeeping, or payroll administration, to bring in candidates whose abilities match your needs.

Use this accountant job summary to make a job-winning return to. Accounting professionals aid companies make crucial monetary choices and corrections. They do this in a range of ways, consisting of study, audits, and information input, reporting, evaluation, and monitoring. Accounting professionals can be accountable for tax obligation reporting and filing, integrating annual report, assisting with departmental and business budgets, monetary forecasting, interacting findings with stakeholders, and more.

Report this page